- The ROIC is the operating profit divided by the invested capital. It tells us how much money the company can generate with new capital by investing in profitable projects.

- The ROIC basically explains how much shareholder wealth could be generated in the future and is oftentimes highly correlated with a high P/E.

Return on invested capital, or ROIC, is a valuable financial ratio A high ROIC rewards companies that are able to produce the most net operating profit with the least amount of invested capital.

The basics of ROIC are very simple: it basically tells us how much profits are generated (financials statement) compared to how much capital is invested in the company (balance sheet), provided as a percentage. If the ROIC is 10%, it tells us that the company is generating $10 of profits with each $100 that it invested in the company.

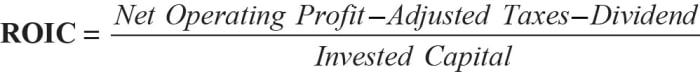

ROIC is net operating profit minus taxes minus dividends divided by invested capital:

ROIC is net operating profit minus taxes minus dividends divided by invested capital:

ROIC is a measure of how much cash a company gets back for each dollar it invests in its business.

ROIC is a much better predictor of company performance than either return on assets or return on equity. In ROA and ROE, the key metric is net income. Net income often has nothing to do with the profitability of a company. Significant expenses are not included in net income such as interest income, discontinued operations, minority interest, etc. which can make a company look profitable when it is not. Also, ROA measures how much net income a company generates for each dollar of assets on its balance sheet. The problem with using this metric is that companies can carry a lot of assets that have nothing to do with their operations, so ROA isn’t always an accurate measure of profitability.

ROE has similar limitations as ROA. ROE is a measure of company profit compared to shareholder equity. Although this might seem a reasonable metric, many companies use financial leverage to raise ROE. Companies often increase debt levels to repurchase shares, thereby increasing ROE. Using this financial leverage to affect ROE does not accurately reflect a company’s profitability, returns or long-term prospects.

Companies with higher-than-median ROIC (when viewed in conjunction with their overall capital-expenditure and operating-expenditure strategy) will deliver better returns.

Valuation biasedness is one of the most common investing errors.

Some investors prefer picking a stock which is “undervalued” rather than buying a more expensive stock with strong long-term fundamentals. As a consequence, they oftentimes end up with “value traps” which actually destroy shareholder value over time. One of the reasons for this is that they know how to “value” a company (via multiples etc.), but lack the ability to determine the quality of a company and its potential to drive long-term value for shareholders.

The most important metric will tell you whether you are buying a good company that is able to generate strong future shareholder wealth: the return on invested capital (“ROIC”).

Basically, investors should look for a high (+10%) and consistent ROIC. In the long run, the ROIC can be a leading indicator of what an investor may expect from longer term stock returns.

References:

- https://www.thestreet.com/opinion/10-stocks-with-high-return-on-invested-capital-and-why-you-should-care-13279076

Like this:

Like Loading...